pay indiana estimated taxes online

To make an estimated tax payment online log on to wwwingovdor4340htm. Fields marked with are required.

Indiana State Tax Information Support

Payment of estimated taxes Estimated payments can be made by one of the following methods.

. Access INTIME at intimedoringov. Indiana Department of Revenue - DORpay. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service.

To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer Information Management Engine INTIME at intimedoringov. Yes I know my Liability Number Yes No. This option is to pay the estimated payments towards the next year tax balance due.

Pay my tax bill in installments. Payment for Unpaid Income Tax 140V-SBI. Pay my tax bill in installments.

Select the Make a Payment link under the Payments tile. INtax only remains available to file and pay the following tax obligations until July 8 2022. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check.

Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and You expect to owe more than 1000 when you file your. Sign In to Pay and See Your Payment History. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247.

Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and. Federal 0 State 1499. View the amount you owe your payment plan details payment history and any scheduled or pending payments.

Follow the links to select Payment type. Claim a gambling loss on my Indiana return. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes.

Take the renters deduction. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. If you have not yet filed your tax return when you reach the File section you have the option to either have the amount due debited from your bank account or you can select the option to mail a checkOr you can use the link below to pay your state taxes due.

FreeTaxUSA FREE Tax Filing Online Return Preparation E-file Income Taxes. Property TaxRent Rebate Status. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest.

E-file directly to the IRS. Know when I will receive my tax refund. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Pay my tax bill in installments. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Take the renters deduction.

To make an individual estimated tax payment electronically without logging in to INTIME. 01-20-2022 Individual Income Tax Filing Opens Jan. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number.

INTAX only remains available to file and pay special tax obligations until July 8 2022. 12-21-2021 Most Indiana Individual Income Tax Forms Now Online. If you expect to have income during the tax year that.

Have more time to file my taxes and I think I will owe the Department. Estimated payments may also be made online through Indianas INTIME website. Find Indiana tax forms.

Individual Estimated IT-40ES Payment. Make a same day payment from your bank account for your balance payment plan estimated tax or other types of payments. Know when I will receive my tax refund.

If you expect to have income during the tax year that. To make payments toward a previous tax year filing please select or link to the Individual Tax Return IT-40 payment option. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247.

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. - scrolls down to website information.

How do i pay state taxes electronically for Indiana on epay system. The Indiana Department of Revenues DOR new online e-services portal INTIME now offers customers the ability to manage their tax account s in one convenient. Go to Your Account.

Do it for free. DORpay is a product of the Indiana Department of Revenue. June 5 2019 250 PM.

Have more time to file my taxes and I think I will owe the Department. Claim a gambling loss on my Indiana return. You should also know the amount due.

Find Indiana tax forms. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Ir a la.

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Dor Keep An Eye Out For Estimated Tax Payments

Mortgage Loans For Central Indiana Indiana Mortgage Lenders Mutualbank Mortgage Loan Calculator Mortgage Loans Online Mortgage

Printable 2021 Indiana Form Es 40 Estimated Tax Payment Voucher

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Indiana Dept Of Revenue Inrevenue Twitter

Indiana Dept Of Revenue Inrevenue Twitter

How To Register For A Sales Tax Permit In Indiana Taxvalet

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Indiana Paycheck Calculator Smartasset

Indiana State Taxes For 2022 Tax Season Forbes Advisor

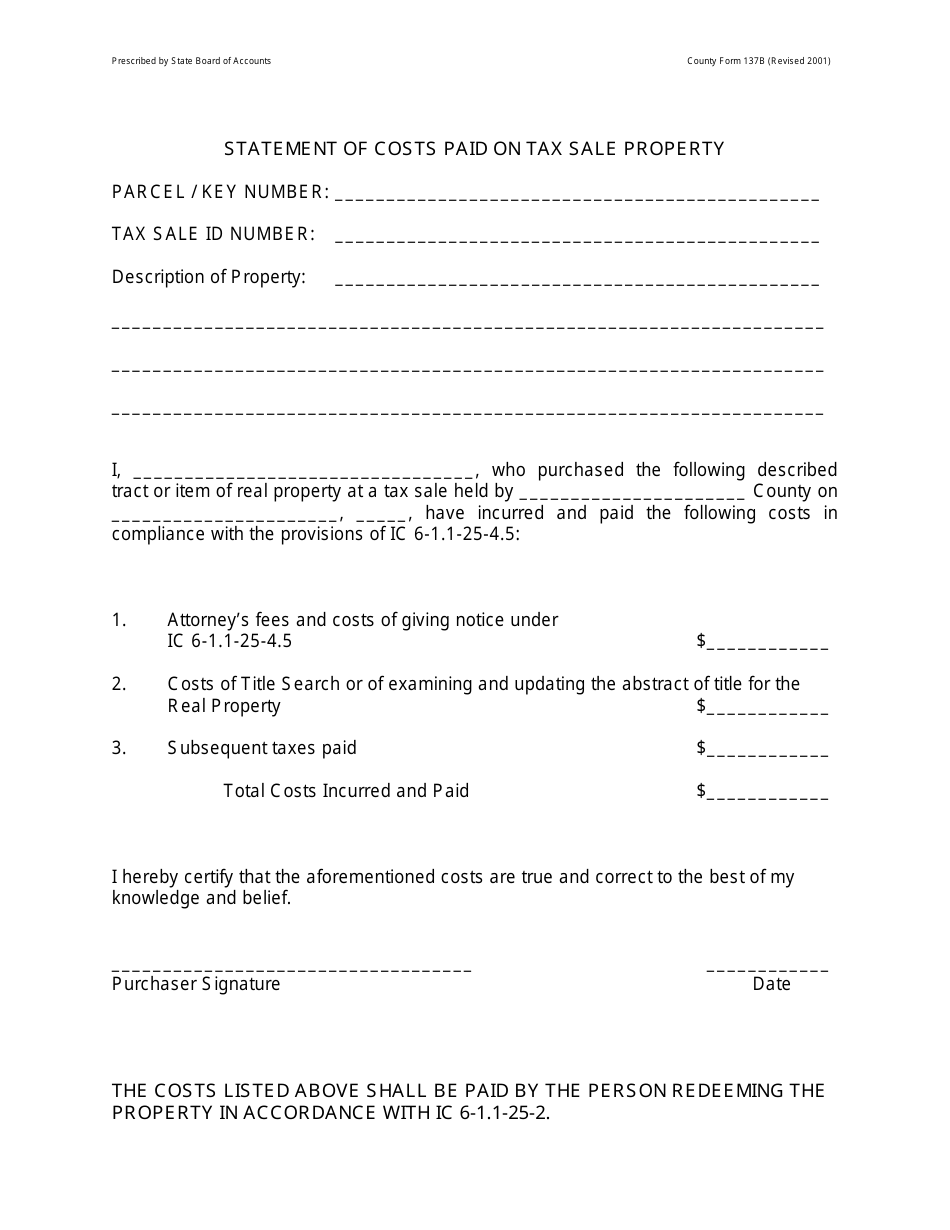

Form 137b Download Printable Pdf Or Fill Online Statement Of Costs Paid On Tax Sale Property Ripley County Indiana Templateroller